What is an EFT payment (Electronic Funds Transfer)?

For personal or business needs, we use EFTs practically every day, making payments using cards, smartphones, or bank transfers. Even in physical sales locations, it is becoming quite common not to accept cash or cheques, and there are reasons for this – the emergence of electronic payments has significantly facilitated financial management.

However, despite the wide usage of EFT payments, not everyone understands what they are and what the money transfer process entails. In this article, we will provide a detailed explanation of what EFT payments are, how they work, list various examples of EFT payment types, and highlight their features and benefits.

What is an Electronic Funds Transfer (EFT)?

EFT is an abbreviation for Electronic Funds Transfer. It may sound overly complicated but the meaning is in fact straightforward – this is just an umbrella term for any movement of funds initiated electronically, whether a payment from one bank account to another, a funds withdrawal, a credit card payment or some other operation.

How does an EFT payment work?

In very simple language, an electronic payment involves transferring money from the sender's bank account to a recipient's account using means other than cash or cheques. This process usually involves such steps as initiation (e.g., you enter your card details to make a purchase online), authorisation (you approve your payment with a 2FA code), transmission (the information on the intended payment is passed to the card issuer), verification (they make sure your account has sufficient amount available to cover the operation and additional fees), and settlement (the recipient receives money into their merchant account).

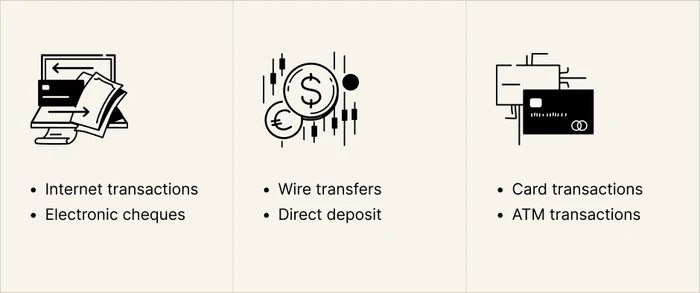

Types of EFT payments

There are many types of EFT payments that can be made, let's look at some of the many examples below.

Wire transfers

A wire transfer is a type of electronic payment where funds are moved between two bank accounts and are usually initiated in an online banking platform, through an app or in a bank branch. To transmit requests for the intended movement of funds, banks use different international or local payment systems such as SWIFT (international), ACH network (within the United States), Faster Payments (within the United Kingdom) and many others.

Direct deposit

Direct deposit (often referred to as direct credit) is a type of EFT where money is paid directly into the receiver's bank account – with no paper checks or bank branch visits needed. It is commonly used for employee payroll or for making recurring payments such as broadband, electricity and other utility bills. The beauty of direct deposits is that the whole process can be automated so that neither the payer nor the payee has to perform any actions – the exact sum will be transmitted from one bank account to another on a certain date.

Electronic cheques

Electronic cheques are a digital version of the good old paper cheques. Commonly used in the US, e-cheques are often accepted in online stores as one of the checkout payment options. In contrast to wire transfers, the payer only has to enter their bank account and routing numbers to initiate the payment.

ATM transactions

Any operations made through automated teller machines (or simply cash machines) also involve launching electronic funds transfers. ATMs usually let you perform basic operations such as withdrawing or depositing cash or paying utility bills without going to a bank branch.

Card transactions

Credit and debit cards are typically linked to a bank account or, in the case of prepaid cards, have their own separate balance. Every time you swipe, tap or enter them in a point-of-sale payment terminal to make a purchase, you instruct your bank or card issuer to perform an EFT payment.

Internet transactions

Card transactions are also the most frequently used payment method when it comes to online shopping or digital service and software subscriptions. An EFT payment is launched when you enter your card details into a checkout form on the website and confirm your payment, which sometimes requires a two-step verification from your bank or financial institution.

What are the benefits of EFT?

The advantages of EFT stem from its electronic nature, offering significant benefits over traditional payment methods such as cash, cheques, and money orders. Electronic funds transfers are:

Convenient

Paying with a beep or a smartphone tap is unarguably more convenient than handling coins and notes. In some cases, you can even transact with no effort whatsoever, such as when setting up Direct Debit to automatically pull funds from your account to pay bills or make instalments.

Quick

Although the majority of payments take 1-2 days to process, increasingly more electronic payments are performed instantly, especially if we are talking about domestic payments.

Secure

Electronic transfer requires no physical money handling which eliminates the risk of money being destroyed, lost or forged.

Less susceptible to human error

EFT payments minimise the risk of human error: your payment simply won't be processed if you provide incomplete or inaccurate bank account details or payment instructions. Moreover, all records of your past transactions are stored making it easy to track and reconcile them.

How long do EFT payments take to clear?

EFT payment processing time may vary widely depending on the geography of the recipient's bank, type of payment (standard/urgent), payment amount, and other factors. Generally, EFT payments are instant to 1 business day while larger transfers or international transactions can take up to 7 days to complete. We explain different payment processing times in more detail in this article.

Are Electronic Fund Transfers safe?

While electronic fund transfer is overall considered a safe way to transfer funds, it is important to acknowledge that online fraud exists and, hence, take necessary precautions. To minimise your risks, transfer money to trusted people and business partners only, regularly check your bank account statements, never shop on non-secure websites, don't share your login credentials or passwords with anyone and use 2FA authentication whenever possible.

EFT vs ACH

These terms are not directly comparable. Any electronic payment method is an EFT, and ACH is just one of them. Automated Clearing House (ACH) network is one of the most popular electronic bank-t0-bank payment methods used for transmitting domestic dollar payments in the United States. There are other networks too such as Fedwire or CHIPS, which are typically used for higher-value, time-sensitive payments.

Similarly, other regions around the world have their own networks, for example, SEPA and Target2 which are used for euro payments in the European Union and can be also considered EFT transactions.

International payments with EFT

EFT payments are undeniably superior to all other alternatives when it comes to cross-border payments. It is much easier to transfer money electronically to someone overseas than to travel across the globe with a bag full of cash, isn't it?

On the downside, for many years, the cross-border payments landscape was dominated by traditional banks and was associated with high fees and unfavourable exchange rates. This situation was particularly harmful to businesses with a need for regular large-volume operations.

However, nowadays there is a growing number of modern financial institutions (EMIs or PSPs) specifically focused on simplifying cross-border payments and multicurrency management. These financial institutions bring companies a lot of opportunities to expand their geographical reach and do business from and with virtually any part of the world.

MultiPass for simpler multicurrency payments

MultiPass is a UK-based bank challenger that makes cross-border business payments a piece of cake. With a wide choice of electronic payment methods, we empower our customers to transact on a global scale just as simply as locally.

Our business accounts support 70+ currencies, instant foreign exchange, local and international payments and corporate expense cards as well as come with professional personal manager support to streamline your international operations. Learn more about us or contact our friendly team for a free consultation.

Get a single business account to transact across over 200 countries and regions