What is SEPA (Single Euro Payments Area) and how does it work?

In the dynamic landscape of international finance and commerce, the Single Euro Payments Area, commonly known as SEPA, has emerged as a pivotal mechanism reshaping the way businesses and individuals conduct euro-denominated transactions across Europe. Understanding SEPA is no longer an option but a necessity for anyone engaged in cross-border payments within the Eurozone.

What is the Single Euro Payments Area (SEPA)?

The Single Euro Payments Area (SEPA) is a European Union initiative designed to create a unified and standardised payments framework across participating European countries. SEPA enables seamless electronic money transfers in euros, making it easier and more cost-effective for individuals, businesses, and banks to conduct cross-border transactions within the SEPA region.

This harmonised system includes credit transfers, direct debits, card and cashless payments promoting financial integration and streamlining cross-border payments. SEPA enables businesses to simplify financial transactions and enhances efficiency while reducing the complexities associated with international money transfers, benefiting both businesses and consumers in Europe.

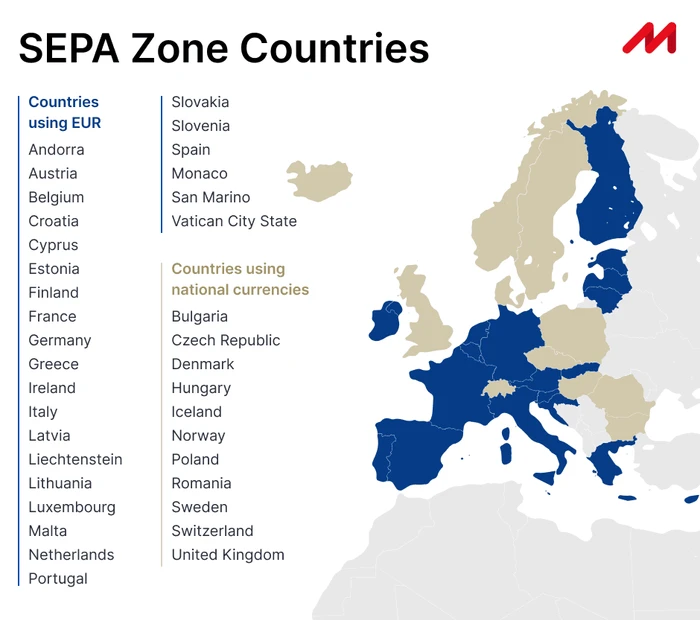

Which countries are included in the SEPA?

There are 36 SEPA countries as of January 2023. The majority of these countries belong to the European Union and European Economic Area, but the region also includes some members of the European Free Trade Association, some non-EU and non-euro countries.

SEPA countries using EUR as domestic currency:

- Andorra

- Austria

- Belgium

- Croatia

- Cyprus

- Estonia

- Finland (also includes Aland Islands)

- France (also includes French Guiana, Guadeloupe, Martinique, Mayotte, Saint Barthélemy, Saint Martin (French part), Réunion and Saint Pierre and Miquelon)

- Germany

- Greece

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Portugal

- Slovakia

- Slovenia

- Spain (also includes Canary Islands and Ceuta en Melilla)

- Monaco

- San Marino

- Vatican City State

SEPA countries using national currencies:

- Bulgaria

- Czech Republic

- Denmark

- Hungary

- Iceland

- Norway

- Poland

- Romania

- Sweden

- Switzerland

- United Kingdom (including Gibraltar, Guernsey, Jersey and Isle of Man)

How has Brexit affected the UK's membership in SEPA?

Brexit has had a significant impact on the UK's membership in SEPA. Following the UK's withdrawal from the European Union on January 31, 2020, and the end of the transition period on December 31, 2020, the UK technically ceased to be an EU member state. Consequently, it also lost its automatic membership in SEPA.

However, the UK and EU negotiated a Brexit trade deal that included provisions for the UK's continued participation in SEPA. This meant that UK banks and financial institutions could still offer SEPA services to their customers. To ensure uninterrupted cross-border payments, the UK adopted the SEPA scheme's rules, making it possible for businesses and individuals in the UK to continue benefiting from SEPA's streamlined euro transactions.

How does a SEPA bank transfer work?

SEPA payments are known for their speed, typically settling within one business day, and for their cost-effectiveness, with low or no fees for both domestic payments and cross-border transactions within the SEPA area.

- Initiation: The sender, also known as the payer, initiates the SEPA transfer through their bank, either online or in person. They provide necessary details, including the recipient's IBAN (International Bank Account Number), name, payment description and the amount to be transferred.

- Authorisation: The payer's bank verifies the payment request and ensures that there are sufficient funds in the payer's account. Once authorised, the bank deducts the specified amount from the payer's account.

- Transmission: The payer's bank sends the payment instruction to the Clearing House, which acts as an intermediary responsible for processing SEPA transactions.

- Clearing: The Clearing House processes the payment and forwards it to the recipient's bank based on the IBAN provided.

- Receiving Bank: The recipient's bank receives the payment instruction and credits the funds to the recipient's account.

- Notification: Both the sender and the recipient receive notifications from their respective banks confirming the successful transfer of funds.

- Completion: The recipient can now access and use the transferred funds in their account.

European Payments Council and its SEPA Payment Processing Schemes

SEPA Payment Processing Schemes are standardised frameworks enabling efficient euro transactions across European countries. The European Payments Council revises its schemes biennially to align with market requirements and advancements in technical standards. There are 4 main SEPA payment schemes which will be described below but the European Payments Council also provides a single-leg outbound credit transfer scheme to make international transfers between countries as effortless and convenient as domestic transactions.

SEPA Credit Transfer Scheme (SCT)

SEPA credit transfers are typically used for various purposes, including salary payments, bill settlements, and other forms of money transfers, offering a cost-effective and uniform method for cross-border and domestic euro payments. This scheme has streamlined financial transactions, making it convenient and accessible for businesses and individuals alike.

SEPA Instant Credit Transfer Scheme (SCT Inst)

SEPA Instant Credit Transfer (SCT Inst) is an enhanced version of the SEPA Credit Transfer (SCT) scheme. It supports real-time payments between participating banks within the SEPA region. SCT Inst enables funds to be transferred and made available in the recipient's account within seconds, providing a rapid and convenient payment solution. According to the European Payments Council, over 60% of European payment service providers have already joined the SEPA Instant scheme.

This scheme is particularly useful for time-sensitive payments, such as emergency fund transfers, e-commerce transactions, or urgent bill settlements. SCT Inst enhances the speed and efficiency of euro payments, contributing to a more responsive and interconnected European payments landscape.

SEPA Direct Debit Transfer Scheme (SDD Core)

SEPA Direct Debit Transfer (SDD Core) is a standardised payment scheme that enables the collection of funds directly from a payer's bank account for various purposes, such as regular bill payments, subscriptions, and dues. SDD simplifies the payment method by providing a uniform method for direct debit transactions denominated in euros across Europe countries.

SDD transactions are automated, reducing administrative costs and errors for both payers and billers. This standardised approach streamlines direct debit processes, contributing to efficient and consistent payment collections throughout Europe.

SEPA Direct Debit Business-to-Business Scheme

SEPA Direct Debit Business-to-Business (SDD B2B) is a specialised payment scheme designed for business-to-business transactions.

This scheme is particularly useful for companies engaged in trade or recurring business transactions where precise payment terms and flexibility are essential. It enhances the efficiency and reliability of euro-denominated B2B payments within the SEPA region.

How long does a SEPA transfer take?

While SEPA Instant payment is executed in under 10 seconds, a standard SEPA transfer typically takes one business day to complete. However, it's essential to note that the exact timing of standard SEPA transfers can vary depending on several factors:

- Cut-off Times: Banks adhere to designated processing deadlines for SEPA transfers. Should you initiate a transfer after the specified cut-off time, it may not be processed until the subsequent business day.

- Weekends and Holidays: SEPA transfers do not occur on weekends or bank holidays. If you initiate a transfer on a Friday evening, it may not be processed until the following Monday or the next business day after a holiday.

- Recipient's Bank: The recipient's bank also plays a role. Some banks may credit the funds immediately, while others might take a bit longer, which can affect the overall processing time.

- Additional Information: If there are discrepancies or missing information in the payment instruction, it can lead to delays in processing.

Overall, SEPA transfers are designed to be relatively fast and efficient, offering a standardised and cost-effective way to move euros within the SEPA region. If timing is crucial, it's advisable to check with your bank regarding their specific cut-off times and processing policies.

Benefits of SEPA payments

SEPA payments offer several significant benefits for both individuals and businesses within the SEPA region:

- Cost-Effective: SEPA transfers are typically low-cost or even free, making them an economical choice for moving euros within the SEPA zone.

- Efficiency: SEPA payments are processed quickly, usually within one business day, ensuring timely fund transfers.

- Standardisation: SEPA provides a uniform set of rules and formats, simplifying international transactions and reducing administrative complexities.

- Broad Coverage: SEPA includes 36 European countries, promoting financial integration and seamless cross-border payments across the region.

- Enhanced Security: SEPA transactions adhere to high-security standards, reducing the risk of fraud and unauthorized transactions.

- Consumer-Friendly: SEPA Direct Debit provides robust protection for consumers, allowing for refunds and chargebacks when necessary.

- Competitive Advantage: Businesses that have a European IBAN can attract a broader customer base within the SEPA region by allowing customers to pay them locally.

- Cross-Border Trade: SEPA simplifies international trade, making it easier for businesses to engage in international commerce within Europe.

Why choose MultiPass for SEPA transfers?

There are many payment service providers offering SEPA payments for business, however not many offer them in combination with other payment methods like Faster Payments, ACH, SWIFT and more. The advantage of using MultiPass is that allows companies from the UK, EU, UAE, Hong Kong and Singapore to operate more simply and affordably in both the Eurozone and globally with just a single account. With MultiPass you receive a dedicated IBAN and local account details to keep multicurrency balances, avoid unnecessary currency conversion and only convert using bank-beating FX rates. Apply today!

FAQ

Are SEPA payments only in euro?

Yes, the SEPA scheme was specifically created for transactions in the euro currency (EUR).

Are there any SEPA transfer charges?

SEPA transfers typically have minimal or no charges for standard transactions for local businesses and individuals. However, fees may apply for specific services or international SEPA transfers, varying by bank and circumstances.

Are there any limits on SEPA payments?

There is no limit on standard SEPA payments, and a limit of 100 000 EUR for SEPA Instant payments set by the scheme. However, individual banks may set their own limits for SEPA transactions.

Transact both globally and locally with a single business account