Payoneer vs. Wise (ex TransferWise) vs. MultiPass for Business

If you are comparing such services as Payoneer, Wise and MultiPass, you are most probably searching for a multi-currency account for your business. In this article, we skip the personal banking side of Wise and specifically compare the corporate solutions – their strengths, weaknesses and unique features.

💡 We recognise that this review appears on a MultiPass website, and we are competing with Wise and Payoneer in the payment industry. However, our priority is to offer impartial and high-quality information based on industry expertise, publicly available sources, customer reviews, and insights from clients who have interacted with our competitors. While we hope you will consider our services, your choice should ultimately be one that aligns best with your specific business needs. This review is based on data as of November 2023.

What is Payoneer?

Payoneer, founded in 2005 in New York, is a financial services company that provides online money transfer and digital payment services. Payoneer's main focus is cross-border B2B (business-to-business) payments. Its services are tailored to meet the needs of rather small business customers – online sellers, freelancers, and service providers who work with global marketplaces and platforms (such as Upwork, Airbnb, Depositphotos and many others), allowing them to receive payments from international clients with ease. Payoneer is not a bank, it holds e-money (EMI) and financial services licences in 6 countries globally.

What is Wise?

Wise (formerly TransferWise), founded in 2011 in London, is a fintech firm specialising in currency exchange and international transfers using a system of local bank transfers to offer real exchange rates without hidden fees. While its primary focus is on personal accounts for individuals – expatriates, frequent travellers and digital nomads, Wise also caters to freelancers, startups and SMEs that evaluate lower transaction fees for payments in foreign currencies and accounting tool integrations. Wise is licensed as an EMI in several jurisdictions globally.

What is MultiPass?

Founded in 2017 as an internal payment solution for Dyninno Group, MultiPass is a bank challenger serving UK, EU, and UAE-based businesses with multi-currency international payment flows. Specialising in cross-border payments, it caters to industries like wholesale trade, e-commerce, IT and others, offering good exchange rates, cost-efficient payments in local currencies and private banking-like support. MultiPas holds an EMI license in the UK.

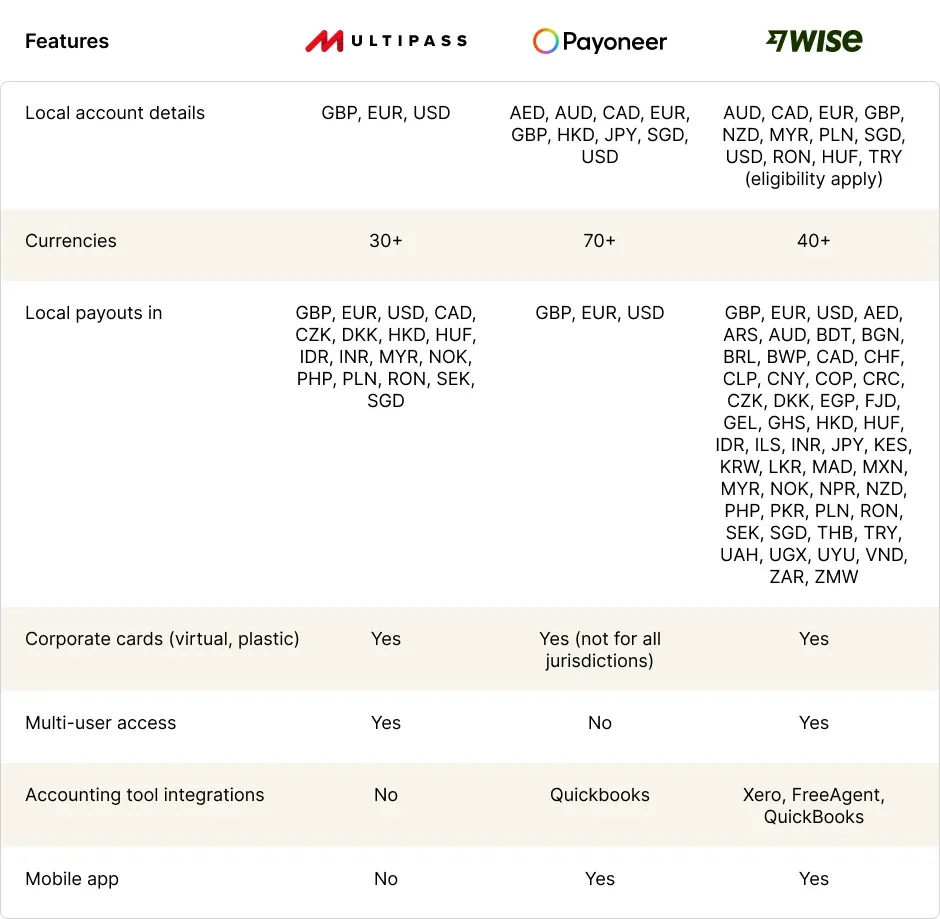

Payoneer vs Wise vs MultiPass – Supported accounts, currencies and features

With both MultiPass and Wise business account you will be able to keep balances in multiple currencies as well as make and collect payments at cheaper rates than with traditional banks. Both have quite wide global coverage for both incoming and outgoing payments via both global and local payment channels.

Payoneer account comes with local bank account details to collect and hold money in 9 currencies (see table below). These local currency collections are free. However, you will not be able to use these receiving accounts for payouts. Local payouts are only available in GBP, EUR and USD, any other currencies will be converted and sent through global channels (SWIFT) at quite pricey rates (up to 3% of the transaction amount, plus a conversion fee).

Which brand offers better exchange rates?

All services offer rates that are competitive versus average traditional bank rates.

The conversion rates on Wise start at 0.43% above the mid-market rate, varying based on the currency and location, while Payoneer charges a 0.5% fee for currency exchanges conducted directly within your account. MultiPass offers fixed rates to customers across all currency pairs, and depending on the plan selected, the rates range from as low as 0.2% to over 1%.

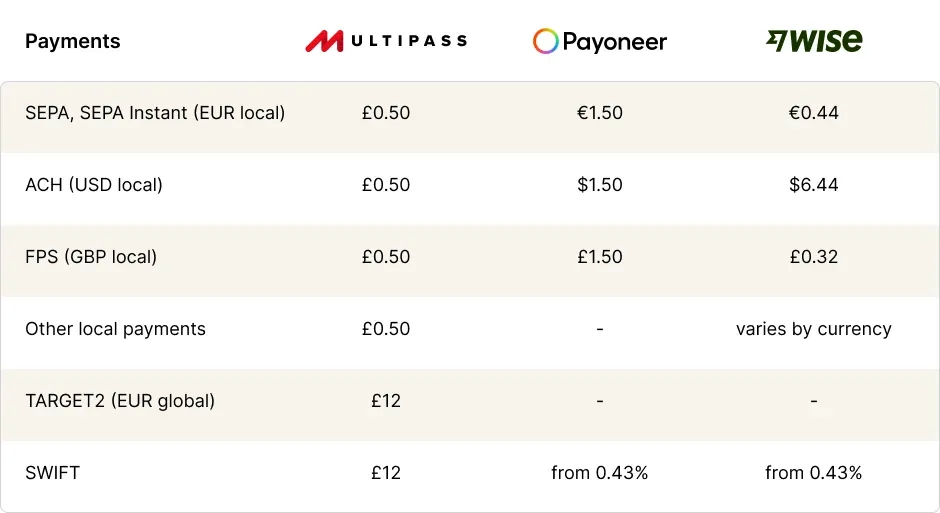

Which brand has lower fees for payments?

Payoneer account seems to focus a lot on free payments between Payoneer users and free collections in multiple currencies. However, when it comes to making international payments, this may not be their strongest niche. Both withdrawing money to the company's own local bank accounts or paying their foreign counterparties in any other locations than the US, UK or EU can be costly.

The table below compares outgoing transfer fees among the MultiPass Global Plan (a special offer for wholesale trade, e-commerce, and IT companies), as well as the standard Wise and Payoneer pricing plans shown on their websites.

Which service is faster?

If we're talking bank transfers, the speed of payment delivery greatly depends on the chosen payment method and the recipient's location. Local payment methods are generally faster with instant to one-day execution time. Both MultiPass and Wise can send many currencies via local networks which makes these services overall faster.

Payments between Payoneer accounts take up to 2 hours, while payments between Wise accounts are instant if made in the same currency, same with MultiPass to MultiPass payments.

For global payments made via SWIFT, the delivery time can be as long as 7 business days, but in most cases, they arrive within 1-3 business days.

Comparing support and ease of onboarding

MultiPass support

MultiPass provides personalised customer support by assigning a Dedicated Manager accessible through multiple channels such as email, phone, and messengers. Pursuing the 'empowered by technology, delivered by people' strategy, the company strives to provide all customers with high-quality payment assistance and guidance for payments in foreign markets. Additionally, Support Team is on standby for customer and general enquiries via phone, email, or online chat and messengers.

Onboarding: With MultiPass, the onboarding process is entirely digital. The company is ready to professionally review applications with more complex ownership or international payment flows often underserved by traditional banks. That is why sometimes, after completing the online form, additional documents might be needed for a comprehensive KYC check. The same onboarding specialist will maintain close communication with the customer to ensure a quick and smooth onboarding experience.

Payoneer support

Payoneer places a strong emphasis on its Payoneer Community Forum, encouraging users to chat and find self-help solutions online. While they do provide account managers for larger enterprise customers, the primary support channels for most users are a multilingual Customer Care team handling email, phone, and chat enquiries. Although this is not an ideal solution for immediately solving payment issues, based on customer reviews, response times through these channels are adequate.

Onboarding: Onboarding with Payoneer seems to be straightforward for freelancers with minimal document submission required, and a bit more detailed for companies.

Wise support

Wise has chosen a digital-first strategy for their services, focusing heavily on building an intuitive UX experience that puts full control in the users' hands. However, this approach also means self-help, with limited support available through FAQ and help centre articles on their website, and email. This can present challenges when dealing with complex issues like payment problems or account freezes. Since different support staff may handle each inquiry, resolving such issues quickly might not always be feasible.

Onboarding: Success rate of being onboarded with Wise is lower and might be similar to some other traditional banks. However, if all documents are in place and the company structure and services are clear and transparent, onboarding should not cause issues.

Conclusion on Wise vs Payoneer vs MultiPass

What Payoneer does well

- Collect money from multiple marketplaces (e.g., Amazon, Walmart) and online services (e.g., Fiverr, Upwork, Depositphotos) into your account or directly onto your Payoneer debit card.

- Invoice customers directly from the platform and receive payments via card or bank transfer.

Where Payoneer could improve

- Sending money via local bank transfer in currencies other than GBP, EUR, and USD is unavailable, which impacts costs and payment speed.

- International money transfers in less common currencies can be expensive.

Who will benefit most from Payoneer

Payoneer is a convenient and easy-to-set-up tool for freelancers and small businesses that need to collect payments from marketplaces and online platforms. Many freelancers use it to consolidate their earnings into their Payoneer receiving accounts and then withdraw the funds in cash from ATMs, as this is often the most cost-effective method. However, it is more tailored as a one-way solution. If you frequently need to send payments in diffferent foreign currencies, this might not be the ideal choice for you.

What Wise does well

- Provides cost-effective international money transfer services across a broad range of global currencies.

- Features convenient UX, payroll and accounting tools.

What Wise for business doesn’t do

- Strict compliance and anti money laundering checks make it challenging for some users to get onboarded or receive timely support.

- While they provide competitive rates, there could be more affordable alternatives for specific routes or high-volume transactions.

Who will benefit most from Wise

Wise account is an excellent tool for startups and smaller businesses dealing with multiple global currencies. It is beneficial for those who need to make regular international transactions without wanting to pay high bank fees. It's a good fit for tech-savvy users with simple business payments who can easily use the platform without the necessity for payment support or consultations. However, for those businesses looking for high-volume transactions and specific regions, it might be worth looking around to see if there's a more tailored solution.

What MultiPass does well

- Low-cost payments in GBP, EUR, USD, CAD, CZK, DKK, HKD, HUF, IDR, INR, MYR, NOK, PHP, PLN, RON, SEK, SGD through local channels and better than bank FX rates. (Other currencies are available as well to be sent or received via SWIFT.)

- Easily accessible personal manager who understands your business and is available for guidance on any banking-related issues.

What MultiPass doesn’t do

- Merchant accounts – if you operate an e-shop, you'll need a separate solution for collecting card payments.

- Although MultiPass internet banking is mobile-friendly, MultiPass currently does not offer an app.

Who will benefit most from MultiPass

MultiPass is a good fit for businesses with suppliers, clients, and a workforce in various locations, such as those in the wholesale trade sector, e-commerce ventures, and IT companies. It caters to both companies that prioritise high-value, time-sensitive payments and require dedicated support and guidance, as well as those handling numerous low-value transactions in exotic currencies. The offer is particularly attractive for businesses based in the UK, EU and UAE.

Apply for a Business Account with MultiPass today!

Payoneer vs Wise FAQs

Can I send money from Payoneer to Wise?

Definitely! To move funds from Payoneer to Wise, simply link your Wise account using Payoneer's "Add Bank Account" feature. After it get reviewed and linked, you can initiate withdrawals directly to Wise. You can connect other bank accounts associated with your company in a similar manner.

Is Payoneer similar to Wise?

Yes and no. Both Payoneer and Wise serve as platforms for international money transfers. Yet, Payoneer is commonly chosen by freelancers and online businesses for its payment collection features, while Wise is known for offering transparent, low-cost multicurrency transfers.

Is Wise cheaper than Payoneer?

Generally, Wise is considered more affordable for international transfers, but it depends on the transaction size and route.

How fast are transactions on Payoneer and Wise?

Wise often offers same-day or next-day transfers. Payoneer's speed can vary based on the transaction type.

Sources:

https://blog.payoneer.com/exclusive/is-payoneer-right-for-you-everything-you-need-to-know-about-whether-youre-eligible-for-a-payoneer-account/

https://payoneer.custhelp.com/

https://payoneer.custhelp.com/app/answers/detail/a_id/20637/~/using-payoneer-to-make-payments

https://payoneer.custhelp.com/app/answers/detail/a_id/43068#section2

https://www.payoneer.com/about/pricing/

https://www.payoneer.com/accounting-software-integration/

https://www1.payoneer.com/in/solutions/send-payment-request/

https://www.payoneer.com/legal/prohibited-transaction-list/

https://wise.com/gb/business/cash-management

https://wise.com/gb/pricing/business

https://wise.com/help/articles/2977974/can-my-business-use-wise

https://wise.com/help/articles/4ijaGT6BdeHNVjzbRip4gI/how-do-i-contact-wise

https://wise.com/us/blog/how-to-send-money-wise-to-wise

https://wise.com/us/blog/wise-transfer-between-currency-accounts

https://www.trustpilot.com/review/wise.com

https://www.trustpilot.com/review/www.payoneer.com

Consider MultiPass: 70+ currencies, global and local accounts, private manager support.