International B2B Payments: Trends & Solutions for SMEs

For a long time, traditional banks have been the big players in the payment industry, and they haven't done much to update the systems and processes for cross-border payments. But things are changing. With new players like neobanks shaking up personal banking, the B2B scene is evolving too. This shift is encouraging business owners, especially those running small and medium-sized enterprises (SMEs), to look for better solutions for managing their international payment flows.

If your growing business is on the lookout for a more efficient and cost-friendly international payment solution, this article offers a simple overview of the B2B payments landscape, options and aspects to consider.

What is a B2B cross-border payment?

A B2B (Business-to-Business) cross-border payment is a financial transaction made between two businesses located in different countries. For example, a company in the United Kingdom paying an invoice to a supplier in Hong Kong for goods received is engaging in a B2B cross-border payment.

Global B2B payments market trends

The global payments landscape is experiencing a significant upward trend, with McKinsey's Global Payments Report highlighting a robust 13% increase in cross-border payment flows, reaching about $150 trillion in 2022. By 2027, it's expected that instant payments will constitute a much larger share of overall payment transactions, indicating a trend towards real-time, lower-fee payment methods.

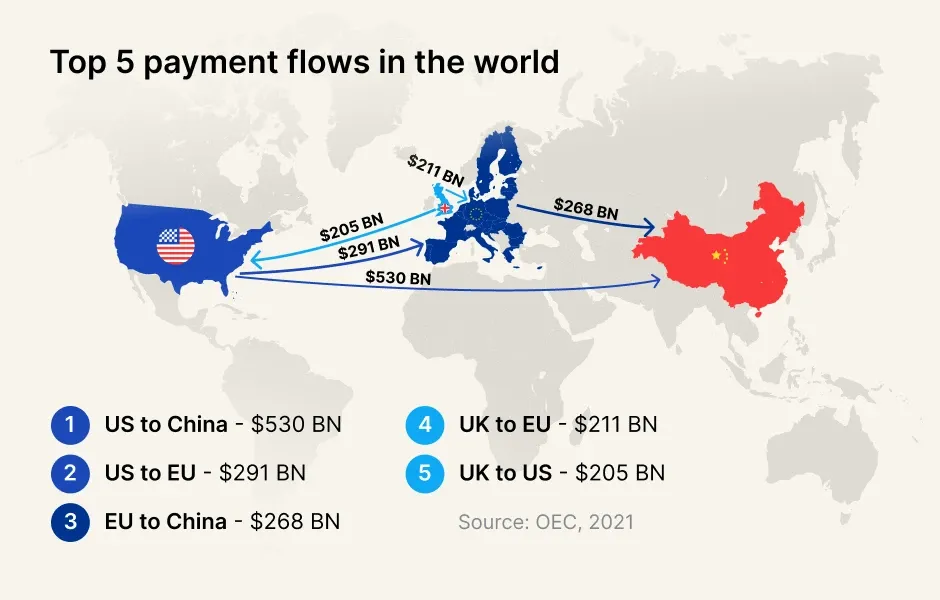

The global payment flows are primarily led by the world's top exporters and importers, with China and the United States at the forefront. Most international B2B transactions are conducted in a handful of key currencies, primarily the USD, EUR, GBP, and CNY, all of which rank among the world's most frequently traded currencies.

What are the existing options for business-to-business international transactions?

- Wire transfers (supported by both banks and neobanks/fintechs): Wire transfers are a reliable and common method for international B2B payments, allowing for direct bank-to-bank fund transfers.

- Credit/debit/prepaid cards: Corporate cards provide a quick and convenient way to pay invoices or business subscriptions in most currencies, often with added benefits like reward points or cash back, but might come with foreign transaction charges.

- Digital payment platforms (e.g. PayPal, Payoneer or MultiPass): Digital payment platforms often accumulate functionality of multiple banks globally, allowing businesses to send and receive payments internationally, often with lower fees and the ability to handle multiple currencies.

- Payment gateways (e.g., Stripe): Payment gateways are used for e-commerce to provide a secure pathway to collect payments from cards through online shopping carts, marketplaces, payment links, and other digital channels.

- Blockchain and cryptocurrency (e.g. crypto exchanges like СoinsPaid, Uphold): Blockchain technology facilitates secure and transparent international payments with cryptocurrencies like Bitcoin or Ethereum. This option is gaining traction for its potential to minimise costs and reduce transaction times.

- Cash transactions (e.g. via Western Union and MoneyGram) are straightforward but may not be practical for international B2B payments due to high costs, legal, security and logistic challenges.

When should you consider special payment providers for cross-border payments?

If your business operates solely within a single country, like a barber shop in the UK, or within a single currency area, such as exporting clothing from Germany to Latvia (both in the Eurozone), a regular bank account should suffice. However, as soon as you require currency exchange – for instance, if you have suppliers, clients, or a workforce overseas – it's time to evaluate whether you are losing money with a traditional bank. These are often businesses that need to make:

Large Value Transactions

For businesses that frequently handle large transactions, such as those in the dropshipping or reselling sectors, keeping costs low is key to maintaining profit margins. Traditional banking fees often consist of a fixed fee or a percentage of the transaction amount plus a currency conversion fee, which can take a significant bite out of your profits. It’s particularly crucial for businesses with low profit margins to find a payment provider that minimises these costs.

Multiple Low-Value Transactions

The situation becomes even more challenging with multiple low-value transactions. Each transfer can incur fees, sometimes as high as 40 GBP (including outgoing and intermediary bank fees), which can rapidly accumulate to a substantial amount. Imagine the financial impact on a travel agency that deals with numerous hotels, bus rentals, restaurants, and guides across different countries, or a tech company that pays a team of freelance software developers around the world. In these cases, each fee adds an extra burden to the business’s bottom line.

The current challenges of global payments with traditional banks

- Expensive Transactions: Each international transfer can incur substantial costs, which can quickly accumulate, particularly when dealing with frequent or large B2B payments.

- Slow Processing Times: Traditional bank transfers are sent internationally via the SWIFT network often involving multiple banks. It can take several days to clear, causing delays that can disrupt business operations and cash flow management.

- Lack of Transparency: Often, businesses are not provided with clear, upfront costs for transactions, leading to budgeting and forecasting complications. Moreover, additional fees can be deducted from the payment by each processing bank, resulting in your recipient receiving less.

- Regulatory Hurdles: It's not rare for B2B payments to be halted for additional checks, returned, or blocked due to the complex nature of compliance and international financial regulations. In these instances, banks often fall short in providing clear communication and support.

Available solutions

By partnering with multiple banks, payment and tech providers globally modern e-money institutions and digital payment providers create different products tailored specifically for facilitating B2B cross-border payments. For example, at MultiPass we do it this way:

Cheaper payments globally

We give access and promote the use of local payment rails, and not only SWIFT. These are SEPA for payments in Europe, Faster Payments in the UK, ACH in the USA, IMPS and NEFT in India and many others. They are what locals use and cost just from £1 per payment. Local payments involve no intermediary banks and hence ensure your recipient gets the exact amount promised with no unexpected deductions from the payment.

Quicker payments processing

Local rails are also much quicker with payments being instant to 1 day as opposed to SWIFT payments that take anywhere between 1 to 7 days. You can learn more about the speed of different payment methods here.

Multi-currency balances

Maintain balances in multiple currencies to avoid unnecessary conversions (and associated fees) and receive payments directly from customers to these balances. This approach also helps in protecting your business against fluctuations in currency exchange rates.

Better exchange rates

Save on currency conversion by taking control of the exchange process. At MultiPass you can perform currency exchanges within your account at any time, only as necessary. By managing the exchange process yourself and then sending money directly in the recipient's currency, you will secure a better exchange rate than what your bank would typically use to exchange it for you, ensuring cost savings on every transaction.

Convenient management

One of the most valued functionalities at MultiPass is multi-user management which allows business owners to delegate tasks to team members e.g. accountants to initiate payments for business owners to approve, or employees to only access and block their own corporate cards.

All MultiPass business accounts come with dedicated IBAN and local account details in the US, UK, and EU for quick and easy outgoing and incoming payments in 70+ currencies, along with an FX desk, corporate cards and personalised manager support to assist with transactions and guidance for payments in foreign markets.

Apply today or contact us to discuss your business case!

FAQs

How can businesses mitigate currency conversion risks in cross-border payments?

Businesses can use hedging strategies and negotiate favourable exchange rates with financial institutions.

Are cryptocurrencies a viable option for international B2B payments?

Cryptocurrencies offer potential benefits such as faster transactions, lower fees, and increased privacy but also come with regulatory and volatility challenges. Businesses need to carefully consider these factors before adopting them for large-scale transactions.

How long do international B2B payments take?

International B2B payments typically take 1-7 business days, varying by payment method, currencies, and countries involved. Modern digital payment solutions and fintech innovations are working towards reducing this time frame.

Which currencies are most commonly used in international B2B payments?

The most commonly used currencies in international B2B payments are the US Dollar (USD), Euro (EUR), British Pound (GBP), Japanese Yen (JPY), and Chinese Yuan (CNY). The prevalence of these currencies is largely due to their stability and the size of the economies they represent.

What are the developing trends within international business payment solutions?

Emerging international business payment trends include fintech solutions, blockchain technology, virtual cards, payment automation, API integration and AI for process optimisation.

Pay in 70+ currencies globally with a single MultiPass business account.