What to choose for business: Electronic money institution vs traditional bank account

In today's dynamic business environment, choosing the right financial institution is vital for the success of any enterprise. The decision between an electronic money institution (EMI) and a traditional bank account has become increasingly significant. With the rise of digital technology and changing customer expectations, EMIs offer innovative solutions tailored to modern businesses.

In this article, we explore the key differences between EMIs and traditional banks, highlighting their unique features, benefits, and limitations. By examining factors such as setup procedures, transaction capabilities, accessibility, and regulatory compliance, we aim to provide businesses with valuable insights to make an informed choice that aligns with their financial goals.

What is an EMI?

An Electronic Money Institution (EMI) is a financial entity or payment institution that operates in the digital space, providing electronic payment services and issue electronic money. Unlike traditional banks, EMIs focus on leveraging technology to offer efficient and flexible financial solutions to individuals and businesses.

The e-money license allows them to open and maintain accounts, receive and send payments, issue cards, and conduct other financial activities in a streamlined and digitally-driven manner. But there are some services that can only be offered with a banking license such as cash transactions, loans or asset management services, for example.

What services do EMIs offer?

Electronic Money Institutions (EMIs) offer a range of services designed to cater to the needs of modern businesses operating in the digital era.

One of the primary services provided by EMIs is the ability to open and maintain business bank accounts, offering a secure and efficient platform for managing finances.

EMIs also facilitate electronic fund transfers, enabling businesses to transfer money domestically and internationally, often with reduced transaction fees and faster processing times compared to traditional banks.

Additionally, EMIs often provide currency exchange services, allowing businesses to conveniently convert funds between different currencies as needed.

Electronic money institutions may issue payment cards (often prepaid), giving businesses the flexibility to make purchases and withdrawals both online and offline.

Some EMIs offer advanced financial management tools, such as real-time transaction monitoring, customizable reporting, and integration with accounting software, empowering businesses to track and analyze their financial activities with ease.

Overall, EMIs combine technology-driven solutions with financial expertise to offer businesses efficient, flexible, and cost-effective services that cater to the demands of the digital age.

How are EMIs regulated?

Electronic money institutions are regulated financial entities that operate within a regulatory framework specific to electronic money and payment services. The exact regulations governing EMIs may vary depending on the jurisdiction in which they operate. For example, in the UK EMIs are licensed and governed by the Financial Conduct Authority while in Lithuania - Bank of Lithuania. Overall, these authorities may include central banks, financial supervisory bodies, or specialised agencies responsible for overseeing payment systems.

Regulatory requirements typically focus on areas such as customer protection, anti-money laundering (AML) and counter-terrorism financing (CTF) measures, data privacy, capital adequacy, and operational risk management. EMIs are often subject to regular audits, reporting obligations, and compliance checks to ensure adherence to regulatory standards. Adhering to regulatory guidelines helps to instil trust and confidence in EMIs, promoting a secure and transparent environment for businesses and customers alike.

How your money is held in an e-money account?

In an e-money account, the way your money is held can vary depending on the specific policies and practices of the Electronic Money Institution (EMI) you are using. Typically, EMIs operate under strict regulatory guidelines that govern how customer funds are handled. The funds held in an e-money account are generally kept separate from the EMI's own operational funds, ensuring that it is segregated and protected. This segregation of funds is intended to safeguard customer funds in the event of the EMI facing financial difficulties or insolvency. You can learn more details in this article where we explain how we safeguard money at MultiPass.

Electronic money institutions may choose to hold client funds in various ways, such as placing them in designated bank accounts or holding them in custodian accounts. Some EMIs may also invest them in low-risk assets to generate a return, while still maintaining the ability to honor customer withdrawals and transactions promptly. These mechanisms and protections for holding customers' funds may differ between EMIs and jurisdictions – make sure to learn the exact process at the EMI of your choice, before committing to their services.

How do banks work?

Banks are financial institutions that offer a wide range of financial services to individuals, businesses, and other organisations. Here is a step-by-step breakdown of how banks operate:

- Accepting Deposits: Banks receive deposits from individuals, businesses, and organisations. Customers can open various types of accounts, such as savings accounts, checking accounts, or certificates of deposit (CDs). These deposits provide banks with a pool of funds to operate and lend to borrowers.

- Lending: One of the primary functions of banks is to lend money to individuals, businesses, and governments. Banks use the funds deposited by customers to provide loans for various purposes, such as buying homes, starting businesses, or financing projects. The interest charged on loans is a key source of revenue for banks.

- Bank Transfers: Bank transfers allow individuals and businesses to move money electronically between accounts held at different banks. There are two primary types of bank transfers:

a. Domestic Transfers: Domestic bank transfers involve moving funds between accounts within the same country. Customers initiate transfers by providing the recipient's account number, bank's routing number, and any additional information required. The funds are then debited from the sender's account and credited to the recipient's account, usually within a few business days.

b. Foreign Currency Transfers: International bank transfers enable the movement of funds across borders. Customers need to provide the recipient's account details, including the International Bank Account Number (IBAN), Bank Identifier Code (BIC), and other necessary information. International transfers may involve additional fees and can take longer to process due to currency conversions and intermediary banks. - Clearing and Settlement: After a bank transfer is initiated, the involved banks engage in a process known as clearing and settlement. This process ensures that funds are transferred accurately and securely between accounts. Clearing involves the verification and matching of transaction details, while settlement involves the actual movement of funds.

- Additional Services: Many banks offer additional services such as investment and wealth management, foreign exchange services, safe deposit boxes and others.

- Security and Fraud Prevention: Banks prioritise the security of transactions and implement robust measures to prevent fraud. They employ encryption technologies, secure communication channels, and authentication protocols to safeguard customer information and prevent unauthorised access. Additionally, banks continuously monitor transactions for suspicious activity, utilising advanced fraud detection systems to mitigate potential risks.

Should I use an EMI instead of a bank?

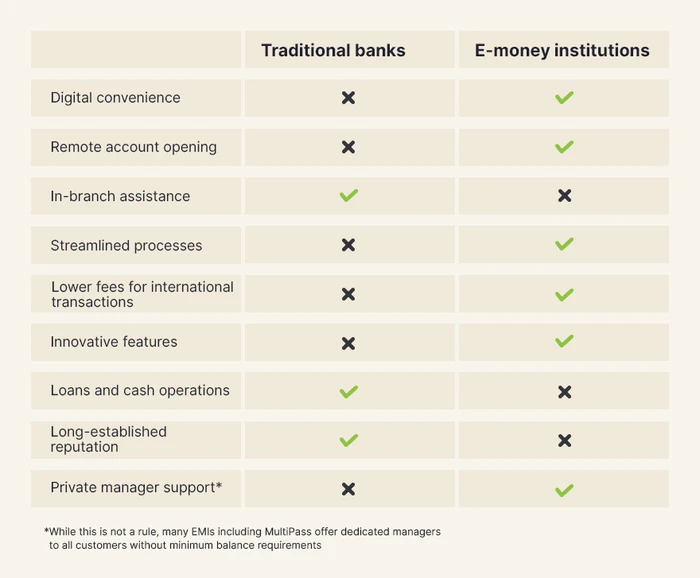

Deciding whether to use an Electronic Money Institution (EMI) instead of a traditional bank depends on your specific needs and preferences. EMIs offer unique advantages such as streamlined digital processes, lower fees, and innovative features tailored to the digital age. They may be particularly appealing for individuals who prioritise convenience, fast transactions, and advanced mobile banking capabilities.

However, brick-and-mortar banks still provide advantages like extensive physical branch networks, a wide range of financial products, and a long-established reputation. Many businesses still choose to use e-money accounts together with traditional bank accounts, using the former for cost savings, superior usability, convenient plugins and integrations with accounting software and other financial management tools while keeping traditional banks for fund storage due to their perceived trustworthiness.

Ultimately, it is important to evaluate factors such as accessibility, service offerings, fees, and regulatory protections to determine which option best suits your financial requirements and aligns with your comfort level in managing your finances.

Pros and cons of electronic money institutions

Electronic Money Institutions (EMIs) offer several advantages and disadvantages compared to traditional banks. Here are some pros and cons of EMIs:

Pros

- Digital Convenience: EMIs operate primarily online, providing a user-friendly digital interface for managing finances anytime, anywhere. Being fully digital also means fully remote onboarding which makes their service more accessible for individuals and companies from overseas.

- Streamlined Processes: EMIs generally offer simplified account setup procedures, faster transaction processing times, and efficient digital documentation, reducing paperwork and administrative hassles.

- Lower Fees: EMIs may have lower fees compared to banks, such as reduced transaction fees, maintenance fees, or international transfer charges.

- Innovative Features: EMIs frequently offer innovative features like mobile payment options, real-time transaction notifications, budgeting tools, and integration with digital wallets, catering to tech-savvy users seeking cutting-edge financial solutions.

Cons

- Limited Physical Presence: EMIs typically lack physical branch networks, which may be a drawback for individuals who value in-person interactions, face-to-face customer service, or require access to services like cash deposits or in-branch assistance.

- Restricted Services: EMIs may have limitations in certain areas such as investment options, loans or specialised financial products, which could be a disadvantage for individuals with complex financial needs or specific requirements.

- Perceived Trust and Reputation: Traditional banks generally have a long-established reputation and history, providing a sense of trust and stability. Some individuals may feel more comfortable relying on well-known banks with extensive experience in the financial industry.

It's essential to consider these pros and cons and assess your personal financial needs and priorities when deciding whether to opt for an EMI or a traditional credit institution.

When to use EMI?

There are several situations where using an Electronic Money Institution (EMI) may be better than using a traditional bank:

- International Transactions: If you frequently engage in international transactions, an EMI can be a better option. EMIs often offer competitive exchange rates, lower fees for cross-border transfers, and faster processing times compared to banks, making them more cost-effective and efficient for global transactions.

- Digital-native Businesses: For businesses operating primarily in the digital realm, an EMI can be a better fit. Many EMIs provide seamless integration with online platforms, accounting services, multi-user access and customisable APIs, allowing digital businesses to save time on accounting and even create custom payment scenarios.

- Startups and SMEs: EMIs often offer more flexible and tailored services for startups and small to medium-sized enterprises (SMEs). They may have simplified onboarding processes, fewer documentation requirements, and lower minimum balance requirements compared to high street banks.

- Tech-savvy Individuals: If you prefer a modern and tech-driven banking experience, an EMI may be a better choice. EMIs typically offer user-friendly mobile apps, advanced digital features, and seamless integration with fintech services, appealing to individuals who prioritise convenience, innovation, and cutting-edge financial solutions.

It's important to assess your specific financial needs, preferences, and the services provided by both Electronic money institutions and traditional banks to make an informed decision that aligns with your requirements.

Should I use a bank instead of an EMI?

The decision of whether to use a bank or an EMI depends on your specific needs. Banks offer a wider range of services and physical presence, while EMIs provide digital convenience and lower fees. Consider your requirements to make the best choice for your business.

Pros and cons of traditional banks accounts

Pros

- Physical Presence: Traditional banks typically have physical branch networks, allowing for in-person customer service, cash deposits, and face-to-face interactions with bank representatives.

- Diverse Range of Services: Banks offer a wide array of financial services, including savings and checking accounts, loans, mortgages, investment products, credit cards, and wealth management services. This breadth of offerings caters to various financial needs.

- Established Reputation and Trust: Traditional banks often have long-standing histories and established reputations, which can foster a sense of trust and confidence among customers.

- Regulatory Protections: Banks are subject to strict regulations and oversight, ensuring customer protection, security, and adherence to legal requirements. They generally have deposit insurance schemes, such as the Financial Services Compensation Scheme (FSCS) in the United Kingdom that protects customer deposits up to £85,000.

Cons

- Higher Fees: Traditional banks may have higher fees compared to Electronic Money Institutions (EMIs). Account maintenance fees, transaction fees, and other charges can add up, impacting the overall cost of banking services.

- Limited Convenience: Physical branch operations may have limited operating hours, leading to potential inconvenience for individuals with busy schedules. Transaction support and private banking services are usually reserved for top-tier clients only.

- Slower Transaction Processing: Traditional banks may have longer processing times for certain transactions, such as international transfers, compared to EMIs.

- Less Innovation: Traditional banks may be slower to adopt and offer cutting-edge technological advancements and digital features compared to EMIs. This can limit the convenience and flexibility provided by digital banking solutions.

Consider these pros and cons based on your financial priorities and preferences when evaluating whether a traditional bank account aligns with your needs.

When to use traditional banks for business transactions?

There are some cases where traditional financial institutions may be a better choice than e-money institutions:

- Extensive Banking Services: If your business requires cash management solutions, customised financing options, or complex treasury management services, traditional banks often have the infrastructure and expertise to meet those needs.

- Domestic Operations: If your business operations are limited to your home market (let's say, you run a barber shop or a catering company), the bank services offered by traditional banks may be sufficient for your needs, they often come with affordable maintenance fees.

- Business Loans: If your business needs access to substantial credit facilities, such as working capital lines of credit or long-term business loans, traditional banks generally have more extensive lending capabilities and a broader range of loan options to support your financial needs.

While EMIs offer digital convenience and cost-effective solutions, traditional banks often provide a wider array of lending and investment services and comprehensive banking infrastructure. Assessing your business requirements, industry considerations, and growth plans will help determine which option aligns best with your business goals.

Why MultiPass is a great choice for your business

Banks are typically expensive when it comes to conducting operations involving foreign currencies. The total fees per international SWIFT payment can easily amount to 40 GBP or more depending on payment size, the number of intermediary banks involved and their fees, and that's without the FX charges. Now imagine you have foreign contractors in India, Emirates, Eastern Europe, or the United States, and you need to make 100 payments monthly.

MultiPass offers a multi-currency business account that saves you money and avoids the need for complex setups. Whether you're just testing new markets or have long-established foreign business connections, you can get access to cheaper local payment networks and bank-beating exchange rates for 70+ currencies with MultiPass and start saving on cross-border payments with MultiPass.

Easily open a MultiPass account online, skipping the travel and paperwork hassles. Apply today!

Apply for a free consultation with MultiPass banking specialists!