Virtual IBAN: What is it and do you need it for your business?

Virtual IBANs, or Virtual International Bank Account Numbers, are a modern banking solution that offer businesses enhanced flexibility and efficiency in managing international transactions and business expenses. This article delves into the concept of Virtual IBANs, their benefits, and whether they are a necessary tool for businesses looking to optimise their financial operations in the global market.

What is an IBAN?

An IBAN (International Bank Account Number) is a standardised format for identifying bank accounts in international transactions. It was developed to streamline and simplify the process of transferring funds between different banks and countries.

When initiating an international payment, the sender needs to provide the recipient's IBAN along with other relevant information like the recipient's name and address. The sender's bank then uses the IBAN to route the funds to the correct bank and account. The IBAN acts as a unique identifier, ensuring that the funds are directed to the intended recipient's account with accuracy.

Upon receiving the funds, the recipient's bank verifies the IBAN to ensure its validity. If the IBAN is correct, the funds are credited to the recipient's account. However, if there is an error in the IBAN or it doesn't match any existing accounts, the transfer may be rejected, delayed, or returned to the transfer money sender.

What is a virtual IBAN?

The terms IBAN and vIBAN are often used interchangeably as their primary purpose is the same – to identify the sender and the recipient when transmitting funds. However, there is a bit more to virtual IBANs than meets the eye.

A virtual IBAN is a concept that offers businesses an additional layer of flexibility and convenience in managing their financial operations, particularly in the context of cross-border payments. Unlike a traditional IBAN, which is often associated with a physical bank account, a virtual IBAN is a virtual representation of an account.

With a virtual IBAN, businesses can generate multiple IBANs associated with a single bank account. Each virtual IBAN functions as a unique identifier, allowing businesses to segregate funds, track transactions, easily identify incoming payments, and simplify reconciliation processes. This can be particularly advantageous for companies engaged in cross-border trade or managing multiple currencies.

The IBANs (various virtual accounts) can be allocated to specific clients, projects, or departments, enabling businesses to efficiently manage funds and monitor financial flows. Payments received through a virtual IBAN are typically routed to the underlying physical account, ensuring that the funds are consolidated in one central location. Virtual IBANs can also provide added security by allowing businesses to share only the virtual IBAN with clients or partners, keeping the underlying physical account information confidential.

What does a virtual IBAN look like?

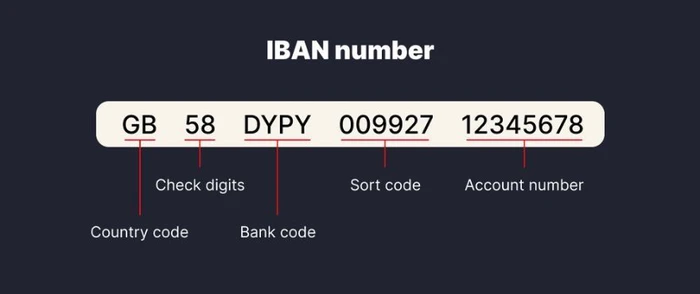

A virtual IBAN follows the same basic structure as a traditional IBAN. However, there can be some variations in its format depending on the provider or banking institution. Here is a general representation of how a virtual IBAN may appear:

The structure of an IBAN varies depending on the country, but it generally consists of a two-letter country code, followed by two check digits, and then a series of alphanumeric characters that represent the bank and account details. The country code helps identify the country where the bank account is held, while the check digits ensure the accuracy of the IBAN by validating its integrity.

Benefits of virtual IBANs

There are a lot of benefits of virtual IBAN for business. Below you can find detailed descriptions of why Virtual IBAN could be a good choice for your company:

Easy Account Setup

Setting up a virtual IBAN is relatively easy due to the streamlined processes provided by banks and financial institutions. Here are a few reasons why it's convenient to set up a virtual IBAN:

- Online Application: Virtual IBAN setup can usually be done entirely online. Banks and providers offer user-friendly platforms or portals where businesses can submit their applications, upload necessary documents, and complete the required information conveniently. This eliminates the need for physical visits to the bank and speeds up the process.

- Integrated Services: Virtual IBAN providers often offer additional integrated services that simplify financial operations for businesses. These services can include multi-currency accounts, foreign exchange capabilities, transaction monitoring tools, and reporting functionalities. Having these features readily available alongside the virtual IBAN setup saves businesses time and effort in sourcing multiple services from different providers.

Functionality

The functionality of a virtual IBAN (virtual account) encompasses several key aspects:

- Fund Segregation: Virtual IBANs allow businesses to segregate funds and allocate them to specific clients, projects, or departments. This functionality enables better tracking and management of financial resources, streamlining cash flow operations.

- Payment Routing: When payments are made to a virtual IBAN, they are typically routed to the associated physical account. Virtual IBANs serve as intermediaries, ensuring that funds are consolidated in one central location, simplifying reconciliation and monitoring.

- Multi-Currency Support: Virtual IBANs often support multiple currencies, allowing businesses to receive payments in different currencies without the need for separate physical accounts. This functionality facilitates cross-border payments and helps mitigate foreign exchange risks.

- Scalability: Virtual IBANs are highly scalable, allowing businesses to generate and manage multiple virtual IBANs as needed. This flexibility accommodates evolving business requirements, such as handling increasing transaction volumes, serving different business entities, or adapting to changing market dynamics.

Cost Saving

Virtual IBANs offer several cost-saving benefits for businesses:

- Reduced Account Maintenance Costs: With virtual IBANs, businesses can consolidate funds into a single physical account while using multiple virtual IBANs for various purposes. This eliminates the need to maintain multiple physical accounts, reducing associated fees and administrative costs.

- Efficient Reconciliation and Reporting: Virtual IBANs streamline reconciliation processes by segregating funds based on clients, projects, or departments. This simplifies the tracking of incoming and outgoing transactions, resulting in time savings and increased accuracy in financial reporting.

- Foreign Exchange Savings: Virtual IBANs that support multiple currencies enable businesses to receive payments in different currencies without the need for separate physical accounts. This reduces the costs associated with currency conversions and foreign exchange fees. This is especially useful when a single physical account can have sets of virtual details in different formats fit for transacting in foreign markets. For example, MultiPass customers receive an IBAN, a UK sort-code and a US account and routing number to send and collect payments in GBP, EUR, USD and other currencies into the very same account.

- Lower Banking Fees: Some virtual IBAN providers offer competitive pricing models that can be more cost-effective than traditional banking services. By leveraging virtual IBANs, businesses may access specialised financial services at lower fees, resulting in overall cost savings.

Security

Virtual IBANs offer several security advantages, making them a secure choice for businesses:

- Confidentiality: Virtual IBANs provide an extra layer of confidentiality compared to traditional bank accounts. When sharing a virtual IBAN with clients or partners, businesses can keep the underlying physical account details private. This reduces the risk of unauthorised access or fraud.

- Enhanced Fraud Prevention: Virtual IBANs help mitigate the risk of fraudulent activities. Banks and providers implement robust security measures to monitor and detect suspicious transactions associated with virtual IBANs. This includes fraud detection algorithms, real-time transaction monitoring, and enhanced authentication protocols.

- Secure Transaction Routing: Virtual IBANs ensure secure routing of payments to the associated physical account. The unique identifier of a virtual IBAN directs funds to the correct destination, reducing the chances of misrouting or misappropriation of funds during the transfer process.

- Compliance with Regulations: Virtual IBAN providers often adhere to strict regulatory standards and compliance requirements. This ensures that security measures, anti-money laundering (AML) protocols, and Know Your Customer (KYC) procedures are in place to maintain a secure environment for financial transactions.

- Provider Expertise and Support: Virtual IBANs are typically offered by reputable banks or financial service providers with expertise in security and risk management. They invest in robust infrastructure, encryption protocols, and data protection measures to ensure the security of their virtual IBAN systems.

How could virtual IBANs help my business?

Virtual IBANs can help your business in several ways. Here are some examples:

- Global Expansion: If your business is expanding internationally, virtual IBANs can simplify your financial operations. For instance, if you're opening a branch or serving clients in a different country, you can generate a virtual IBAN associated with that specific location. This allows you to receive payments locally, improve cash flow management, and avoid the complexity of setting up separate local bank accounts in each country.

- E-commerce and Online Marketplaces: If you run an e-commerce business or sell products on online marketplaces, virtual IBANs can streamline your payment processes. You can assign a virtual IBAN to each marketplace or online platform, making it easier to track incoming payments, reconcile transactions, and identify revenue generated from different sources. This simplifies financial reporting and helps you make data-driven business decisions.

- Client Funds Management: If you operate in industries like real estate, law, or travel, where you handle client funds, virtual IBANs offer an efficient solution. You can allocate a unique virtual IBAN to each client, project, or case, allowing for accurate tracking and management of client funds. This helps ensure transparency, simplifies accounting processes and facilitates the reconciliation of client transactions.

- Currency Management: If your business deals with multiple currencies, virtual IBANs can streamline your currency management. For example, you can assign a virtual IBAN for each currency you work with, simplifying the receipt and conversion of funds. This eliminates the need for separate physical accounts for each currency, reducing foreign exchange costs and streamlining your cash flow.

How to set up a virtual IBAN account with MultiPass?

The process is pretty straightforward – start by completing the online application form and then our banking specialists will contact you to guide you through the required compliance checks in no time. Feel free to consult with us anytime before or during or after submitting the application.

With MultiPass you will get a set of virtual account details, perfect for transacting both globally and in local markets:

- GB IBAN (for EUR payments via SEPA & SEPA Instant and SWIFT global payments in 70+ currencies)

- US account number & routing number (for domestic USD payments via ACH and Fedwire)

- UK sort-code (for domestic GBP payments via Faster Payments and CHAPS)

FAQ

What Are vIBANs and IBANs for?

vIBANs and IBANs are used for identifying bank accounts in international transactions. They serve as unique identifiers that streamline international payments, and ensure accurate routing of funds. IBANs are widely used globally, while vIBANs, or virtual IBANs, offer additional functionality by allowing businesses to segregate funds and enhance financial management capabilities.

Is an IBAN different to a sort code and account number?

Yes, an IBAN is different from a sort code and account number. While a sort code and account number are specific to the United Kingdom's banking system, an IBAN is an internationally recognised format used to identify bank accounts in various countries. IBANs provide a standardised structure for international money transfers that includes country codes, check digits, and bank-specific information, allowing for accurate and efficient cross-border transactions.

Who can use vIBANs?

Virtual IBANs (vIBANs) can be used by businesses of various sizes, including startups, SMEs, and large corporations. They are particularly beneficial for businesses engaged in international trade, e-commerce and other industries involving cross-border transactions, or those looking to optimise fund management, payment segregation, and reconciliation processes.

Does a vIBAN also need an IBAN?

Yes, a Virtual IBAN (vIBAN) is associated with a physical IBAN. While a vIBAN is used to segregate and manage funds within a business, the underlying physical account is identified by an IBAN. The IBAN is necessary for routing funds from physical bank accounts correctly to the vIBAN and ensuring compliance with international banking standards.

A single account to send and collect EUR, GBP, USD and 70+ other currencies