The Difference Between Correspondent, Intermediary and Beneficiary Banks

Whether you're a business with global ties or an individual seeking clarity on international payments, it's important to understand the roles of Correspondent, Intermediary, and Beneficiary Banks. These three entities are central to global transactions. By knowing their specific functions and the processes that lie behind international payments, you'll be better equipped to make informed financial decisions.

What is Correspondent Banking?

Correspondent banking is a partnership between two banks, often from different countries, where one bank provides services on behalf of another bank. In this arrangement, the bank offering the services is called the "correspondent bank," while the bank receiving them is the "respondent bank."

What is a Intermediary Bank?

An intermediary bank serves as a link between the originating bank (where the transaction starts) and the beneficiary bank (where the transaction is meant to end). It plays a vital role, especially when the two banks conducting business don't have a direct relationship with each other.

What is a Beneficiary Bank?

A beneficiary bank is a financial institution where the intended recipient of a funds transfer holds a bank account. It's where the money is destined to go in financial transactions. In banking terms, the beneficiary refers to the individual or entity that is the end recipient of the funds.

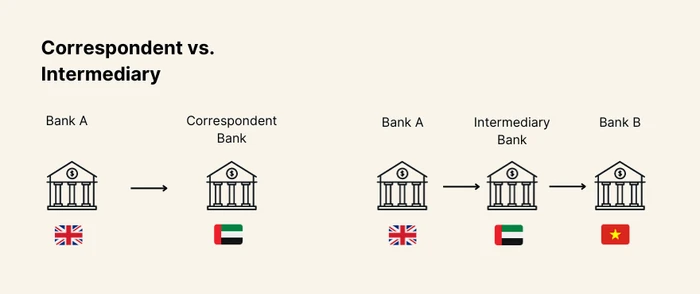

Difference between Correspondent and Intermediary banks

In the intricate realm of international banking, correspondent banks and intermediary banks play indispensable roles, especially when navigating cross-border transfers. Correspondent banks typically work as a representative for another financial institution, often stepping in when that institution lacks a foothold in a specific region. Their primary role is to simplify international money movements, holding funds and directly executing transactions for other financial institutions they represent. For instance, a bank in the US might leverage its correspondent banking relationship with a UK bank to facilitate USD-denominated transfers between the two nations.

Conversely, the intermediary banks emerge as a third party, a bridge when the originating and beneficiary bank don't share a direct link. Acting as the middleman in the financial chain, they ensure funds travel securely and reach their intended endpoint, even in scenarios where multiple stopovers are necessary due to the absence of direct banking relationships. An example could be a small regional bank needing assistance from larger banks to process an international transfer.

In essence, while both these entities benefit the smooth flow of a cross-border transaction, their roles diverge at the operational level. The correspondent bank extends its facilities directly, offering its services in regions where its partner banks are not present. Meanwhile, the intermediary bank patches indirect routes, ensuring transactions aren't halted by the lack of direct bank-to-bank relationships. If a transaction involves an intermediary bank, it means there are 3 or more participants in the chain.

What is Nostro and Vostro?

Nostro and vostro are banking terms used to describe different types of accounts held between banks, primarily for international transactions.

A nostro account is one that a bank holds in a foreign country, in that country's currency; essentially, it's "our account with you." For instance, a US bank might have a nostro account in the UK in pounds sterling.

Conversely, a vostro account is the opposite — "your account with us." Using the same example, the UK bank would view the same account as a vostro account, meaning an account held by the US bank in the UK. These accounts facilitate smooth cross-border transactions and clearances.

What are the advantages and disadvantages of correspondent banking?

Correspondent banking relationships refer to an agreement between two financial institutions where one performs services on behalf of the other. This is commonly used to facilitate international financial transactions, where local banks establish relationships with foreign banks to provide services in those countries. Here's a breakdown of the advantages and disadvantages of correspondent banking relationships:

Advantages:

Access to Foreign Markets

Correspondent banking provides local banks with access to foreign financial markets and currency exchange without the need to establish branches overseas.

Cost Efficiency

Establishing and maintaining a physical presence for a bank in a foreign country can be costly. Through a correspondent relationship, banks can serve their clients in foreign markets without incurring these high costs.

Risk Management

Engaging in direct foreign operations can be risky. Correspondent banking allows domestic banks to move foreign currency and provide international services while delegating many of the operational risks to the correspondent bank.

Expedited Transactions

Correspondent banks often expedite transactions between banks, reducing the time clients have to wait for international payments or transactions.

Local Expertise

The correspondent bank in the foreign country typically has more in-depth knowledge about local regulations, market conditions, and customs. This knowledge can be invaluable for domestic banks and their clients.

Disadvantages:

Dependence

If a correspondent bank faces operational, financial, or legal challenges, it can impact the financial services being offered by the domestic bank, financial institution or payment service provider to its clients, sometimes even leading to customer account closures.

Diluted Customer Relationship

The direct relationship between a beneficiary bank vs correspondent bank might get diluted. For instance, if there's a problem with a transaction, the domestic bank may have to liaise with the correspondent bank, adding layers of communication and potential delays.

Operational Risks

While some risks are delegated to the correspondent bank, new operational risks emerge. These can be due to potential errors, fraud, or inefficiencies on the part of the correspondent bank.

Compliance and Regulatory Challenges

Correspondent banking can introduce compliance risks, especially regarding anti-money laundering (AML) and combating the financing of terrorism (CFT). Regulators globally are focusing more on these areas, which can place additional compliance burdens on banks around the world.

Limited Control

Domestic banks might have limited control over the correspondent bank's operations, which can lead to variability in service quality and customer experience.

Reduction in Correspondent Relationships

Due to increased regulatory scrutiny and the associated costs, the banks globally have been continuously reducing their correspondent banking relationships, a phenomenon known as "de-risking." This can limit the options available for banks looking to establish new relationships.

Are there any transaction fees?

All members of the chain facilitating the payment can deduct different fees for their services – payment processing and currency exchange if required. The originating bank usually charges a separate transfer fee from the sender's account while intermediary and recipient banks often deduct their charges from the transfer amount, which can lead to the recipient receiving less than the original sum sent.

Some banks offer senders control over cost bearing, allowing to choose between OUR, SHA and BEN payment types.

- OUR: The sender pays all fees (originating, receiving and intermediary fees). The beneficiary receives the full payment amount.

- SHA (Shared): The sender pays the originator bank fees, and the beneficiary pays the receiving charges. Intermediary bank fees might be deducted from the principal amount, so the beneficiary might receive less than the original amount sent.

- BEN: The beneficiary pays all fees. The sender sends the money, but all the transaction fees are deducted from the payment, resulting in the beneficiary receiving a reduced amount.

To avoid unexpected transaction costs, it's essential to understand these fees when making or receiving international payments.

Avoid correspondent bank fees with MultiPass

As our world becomes a global village, understanding the nuances of international payments and related fees is crucial – especially for businesses with foreign partners, suppliers or clients. Many might not be aware that certain expenses tied to traditional banks, such as high exchange fees and intermediary charges, are entirely avoidable. At MultiPass, we're here to make international payments simpler and more transparent. Here are two key ways we help businesses save money:

Take control over the exchange rate. A substantial portion of costs stems from unfavourable exchange rates, which can significantly erode profit margins. This is especially important for businesses operating on slim margins, like dropshippers or resellers. A single payment to a supplier at an unfavourable rate can be so costly that it could make the whole business deal pointless. With MultiPass, you can access bank-beating exchange rates for 30+ currencies, and convert money only when required, keeping them in a multi-currency account and avoiding needless further conversions.

Use local payment methods. Using local payment methods in different markets can be a significant cost-saver compared to the traditional SWIFT network used by most banks for international payments. With MultiPass you can pay directly in the recipient's currency using local rails, be it ACH in the US, SEPA in the EU or 20+ other payment methods. These methods used by locals are often up to 40 times more affordable (starting from just £1 per payment as opposed to £10-£40 with traditional banks) and can be processed within a day or even instantly.

Whether you're a business aiming for overseas expansion or have existing multi-currency flows, take charge of your international transactions with MultiPass. With our expert guidance and dedicated personal manager support, navigating global payments becomes a breeze. Apply today or contact us to discuss your business case!

Pay in 70+ currencies globally with a single MultiPass business account