How do cross-border payments work?

In our increasingly globalised world, businesses and individuals are conducting transactions across borders more than ever before. Whether you’re an eCommerce store selling to a customer in another country or an individual sending money to family overseas, understanding cross-border payments is crucial.

But how exactly do these transactions work? In this article, we’ll break down the intricacies of cross-border payments and shed light on the mechanisms behind them.

What are cross-border payments?

Cross-border payments are transactions where the payer and recipient are based in different countries, necessitating the movement of funds across international boundaries.

Historically, cross-border payments have been facilitated through banks using a network of correspondent banking relationships. However, with technological advancements, the landscape has evolved to include digital payment platforms, cryptocurrencies and fintech solutions that broaden the options for both retail and wholesale cross-border payments, often providing faster, more cost-effective and transparent methods.

The traditional international payment process typically involves currency conversion, adherence to international and local regulations, and passing through multiple intermediaries in separate countries, each adding a layer of complexity and cost.

Why do cross-border payments matter?

Cross-border payments play a pivotal role in today's interconnected global economy. They enable businesses to tap into international markets and facilitate trade, bridging the gap between countries with differing currencies and financial systems.

For individuals, these global payment solutions make it possible to send remittances to other countries, purchase products from overseas, or even invest in foreign ventures.

These cross-border transactions not only foster economic growth but also promote cultural exchange and strengthen personal and business connections across boundaries.

How cross-border payments work

Cross-border payments operate by transferring funds from one country to another, essential for international trade and personal remittances.

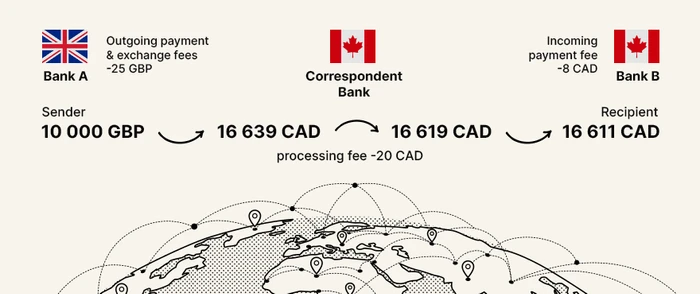

Typically, a cross-border payment is sent through the correspondent banking network, involving multiple banks and institutions to facilitate the transaction. If the sender's bank does not have a direct relationship with the recipient's bank, it selects a correspondent bank to process the transaction. The sender’s bank sends the payment order to this correspondent bank, which may then liaise with other intermediary banks as needed before the funds reach the recipient's bank account. Each participating entity ensures the payment is legitimate and compliant with relevant regulations. Throughout this journey, additional charges are applied by each participant, such as payment processing and currency conversion fees.

The evolution of digital platforms and blockchain technology is modernising this traditional global payment system, providing faster, more transparent, and cost-efficient solutions, making it essential for individuals and businesses engaging in international transactions to understand the workings of global payments for optimal financial decision-making.

What are cross-border payments used for?

Cross-border payments are primarily used for transferring funds between individuals and entities located in different countries. Their applications are vast and varied:

International trade

Cross-border payments are instrumental in global trade, enabling businesses globally to transact efficiently. By facilitating payments for goods and services sourced from overseas, they bridge the gap between diverse currencies and financial systems. As globalisation accelerates, the reliance on seamless payment providers for cross-border payments becomes paramount, ensuring smooth trade flow and bolstering economic connections between nations.

Travel and tourism

Cross-border payments play a crucial role in streamlining transactions in travel and tourism. Whether it's booking accommodations abroad, reserving exotic tours, or managing on-the-go expenses, these payments bridge currency differences, enhancing the travel experience. As international travel surges, the demand for efficient cross-border financial solutions in the tourism sector continues to grow, driving seamless global adventures.

Remittances

Cross-border payments are pivotal for international remittances, enabling individuals to send financial support across international boundaries. These transfers, often from migrant workers to their families back home, bridge monetary divides and play a significant role in global economies. With the rising mobility of the global workforce, the significance of efficient cross-border remittance solutions is more pronounced than ever.

Investment

Cross-border payments empower global investments, allowing investors to diversify portfolios beyond domestic markets. By facilitating funds transfer for foreign assets, stocks, or real estate, these payments promote international financial integration. As investors seek opportunities worldwide, seamless cross-border transactions become essential, unlocking global markets and driving financial growth across borders.

International charitable donations

Cross-border payments are vital for international charitable donations, enabling benefactors to support causes globally. As global challenges arise, the need for efficient and transparent cross-border donation mechanisms grows, fostering a united response to pressing humanitarian issues.

Cross-border payment methods

Cross-border payment methods represent varied mechanisms, ranging from traditional bank transfers to modern digital platforms that facilitate the seamless foreign exchange of currencies and make international trade, remittances, and various global transactions possible.

Wire transfers

Wire transfers serve as a cornerstone of cross-border payments. Facilitating secure bank-to-bank transactions, they ensure the rapid transfer of funds across international boundaries. Even as individuals and businesses venture into new methods of international payment, wire transfers maintain their prominent position in the cross-border transaction landscape. Most banks and payment institutions worldwide utilise this method, with the majority of these payments being routed through the SWIFT messaging system.

Credit card transactions

Cross-border credit card transactions have transformed the way we shop globally, allowing for effortless purchases across international borders. The cards come in various forms, including virtual and physical options, with prepaid balances or those linked to bank accounts. By automatically converting between various currencies and providing swift approvals, they create a seamless trading environment for both consumers and merchants and are used globally for both personal and business purchases.

International money orders

International money orders serve a vital role as a trusted payment method in cross-border payments, offering a pre-paid, tangible means to transfer funds abroad. Services like Western Union and MoneyGram operate globally and are commonly used for sending money internationally, primarily to individuals. They provide recipients with guaranteed payment upon presentation. These services are often more expensive than traditional bank transfers but still remain relevant in the cross-border payment ecosystem for smaller, urgent transfers, especially in underbanked regions.

Online payment platforms

Cross-border online payment platforms have reshaped global commerce, offering intuitive, digital solutions for international transactions. Platforms like PayPal, Wise or MultiPass provide users with quick, cost-effective methods to send and receive funds across borders. By partnering with different financial institutions and banks they are often able to offer more flexible ways to send money abroad, such as local payment methods, better FX rates and more.

Cryptocurrencies

Cryptocurrencies are emerging as an innovative global payment solution – they leverage blockchain technology to offer decentralised, secure, and swift transactions globally. With the rise of digital assets like Bitcoin and Ethereum, the realm of international finance is changing. Yet, their value can be unpredictable, and regulatory issues still linger. While cryptocurrencies offer promise for global transactions, one should weigh the benefits against potential risks when using this cross-border payment method.

What are the key challenges for cross-border payments?

Cross-border payments, while instrumental in fostering global economic activity, come with their set of challenges:

- Complex Regulations: Each country has its own set of financial regulations and compliance requirements. Navigating through these can be complex, especially for businesses trying to operate in multiple jurisdictions.

- Currency Conversion Costs: When money is sent across borders, it often needs to be converted into another currency, incurring costs and sometimes unpredictable fluctuations in exchange rates.

- High Fees: Sending money across borders using conventional banking systems involves intermediary bank fees, service charges, and other hidden costs.

- Slow Processing Times: It can take several days to execute cross-border payments using traditional correspondent banking process, leading to delays and potential losses, especially if time-sensitive.

- Lack of Transparency: It's not always clear how much a transaction will cost in total or how long it will take for funds to be received, leading to uncertainties for both senders and recipients.

- Limited Accessibility: Not everyone has access to international banking services, making it difficult for some populations to send or receive money internationally.

- Reconciliation Difficulties: Mismatched information or discrepancies in payment details can lead to payment delays, necessitating manual intervention to resolve.

- Inefficient Legacy Systems: Many banks still rely on outdated technology for processing international payments, leading to inefficiencies and a lack of integration with newer payment systems.

To overcome these challenges, the financial industry is continually innovating, with fintech startups and established players alike introducing new technologies and systems, such as blockchain and digital payment gateway platforms, to streamline cross-border and domestic payments, and enhance user experience.

Streamline cross-border payments for your business

Why stay tangled in the complex web of traditional systems? With MultiPass, revolutionise how your business handles cross-border payments. We understand the importance of timely and secure transactions with overseas business partners and are committed to enhancing cross-border payments for UK/EU and UAE-based businesses.

Make the switch, and let MultiPass streamline your cross-border payments.

FAQ

What are the benefits of using online payment platforms for cross-border payments?

Online platforms often offer user-friendly interfaces, transparent fee structures, and faster transaction times.

How do cryptocurrencies enhance cross-border payments?

Cryptocurrencies can reduce transaction fees and bypass traditional banking systems, making transfers quicker and more straightforward.

Why are transaction fees higher for international payments?

Fees account for currency conversion costs, service charges by intermediaries, and the inherent risks in international transfers.

How do financial institutions create accountability in cross-border transactions?

They adhere to international regulations, cooperate with other countries and relevant international organisations, and employ robust security measures.

Is it safer to use wire transfers or credit card transactions for international payments?

Both methods are secure, but their suitability depends on the transaction's purpose, amount, and the parties involved.

Reach recipients in 200+ countries and regions, transaction support available