9 Reasons to Separate Business and Personal Bank Accounts

Unlock financial success and security by understanding the importance of separating your business and personal bank accounts. Discover how legal protection, financial clarity, and streamlined financial management can benefit your business. In this article, we unveil the compelling reasons that will transform the way you handle your business credit history and finances.

What do we mean by business transactions?

Business transactions are the financial activities and exchanges that occur between a business entity and other parties. They can be categorised into several types based on their nature and purpose. Here are some common types of business transactions:

- Sales Transactions: The exchange of goods or services for money from customers.

- Purchase Transactions: The acquisition of goods or services from suppliers in exchange for payment.

- Expense Transactions: Payments made for various operating expenses, such as rent, utilities, salaries, and office supplies.

- Income Transactions: Receipt of revenue from various sources, including sales, investments, and interest.

- Cash Transactions: Any transaction involving the movement of cash, such as cash sales, cash purchases, and withdrawals.

- Credit Transactions: Transactions where payment is deferred to a later date, often involving accounts receivable and accounts payable.

- Asset Transactions: Buying, selling, or exchanging assets like machinery, equipment, vehicles, or real estate.

- Liability Transactions: Transactions related to borrowing or repaying debts, like loans and loan repayments.

- Equity Transactions: Transactions related to investments and contributions by owners or shareholders into the business.

- Non-Cash Transactions: Transactions that don't involve cash directly, such as barter exchanges or issuance of stock for services.

Proper recording and understanding of these various types of business transactions are essential for maintaining accurate financial records, analysing the financial health of the business, and making informed business decisions.

Why you shouldn't use your personal bank account for business?

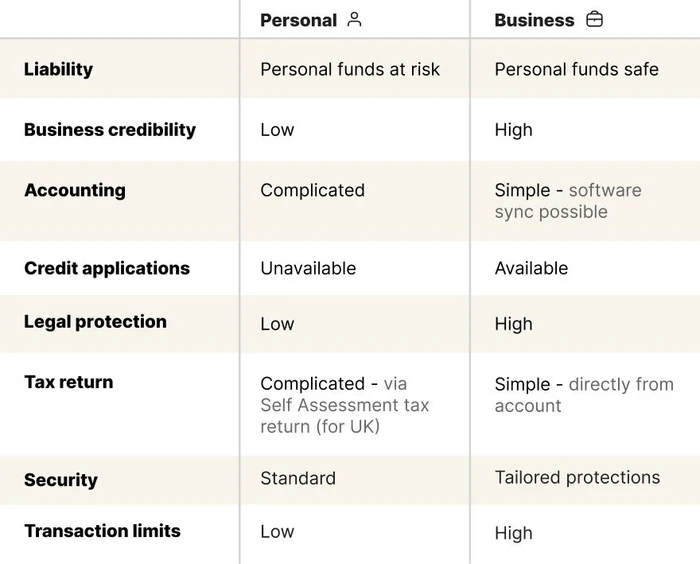

Using a personal bank or personal checking account for business payments is not recommended due to several critical reasons.

First, it blurs the line between personal expenses and business finances, making it challenging to track business-related expenses and income accurately. This can lead to confusion during tax reporting and potential legal issues.

Additionally, commingling funds increases the risk of losing the limited liability protection offered by certain business structures, exposing personal assets to business liabilities. From a professional standpoint, mixing personal funds and business funds in transactions can undermine the credibility of the business, as it appears unprofessional and lacks financial transparency.

Having a separate business bank account ensures proper financial organisation, legal protection, and accurate accounting of business costs, contributing to the long-term success and stability of the business.

Reasons to keep separate business and personal bank accounts

In the realm of business finance, drawing a distinct line between personal and business matters is a fundamental practice. One of the most critical steps entrepreneurs and small business owners can take to maintain this boundary is by keeping separate business and personal bank accounts. This simple yet pivotal measure brings a multitude of benefits and advantages that contribute to the overall success and stability of a business.

Limit liability

In the event of legal action against your business, having business money in separate accounts ensures that creditors and legal claims are limited to the assets within the business account, and they cannot reach your personal savings, investments, or property. This separation is especially critical for business structures that provide limited liability protection, such as LLCs and corporations, as it helps preserve the limited liability status of small businesses.

By limiting liability through separate bank accounts, you secure your personal financial future and shield yourself from the potential financial consequences of business-related challenges. It also demonstrates a responsible and professional approach to managing your business finances, further strengthening your credibility with stakeholders and potential investors.

Credibility

Maintaining separate business and personal bank accounts also enhances the credibility of your business. When you have a dedicated business bank account, it demonstrates to customers, suppliers, investors, and other stakeholders that your business is a legitimate and professional entity.

Credibility is essential in establishing trust with customers and clients. When they see that you have a separate business account, it assures them that you are running your business responsibly and transparently. It also provides a clear financial trail for transactions related to your business name, products or services – some companies may even refuse to make a payment to a personal account as keeping clear financial records is crucial for them.

Moreover, having a separate business account makes it easier for others to do business with you. Suppliers may prefer working with businesses that have dedicated accounts, as it indicates financial stability and commitment. Investors and lenders may also view a separate dedicated business account as a sign of good financial management, increasing your chances of a business loan and securing funding for growth and expansion.

Accounting

Accounting for business bank accounts is superior to personal accounts for several reasons. Business accounting involves tracking revenue, expenses, and profits specifically related to the business, enabling accurate financial reporting, tax compliance, and better financial decision-making.

Additionally, it helps maintain the legal separation between personal and business expenses and finances, protecting personal funds from business liabilities. Business accounting fosters financial transparency, credibility, and effective financial planning, ensuring the long-term success and growth of the business.

Credit applications

Credit applications for business bank accounts offer distinct advantages over personal accounts. For businesses, credit applications provide access to business loans, lines of credit, and credit cards tailored to the company's financial needs. These credit facilities can be crucial for funding business growth, managing cash flow, and making strategic investments.

Additionally, using a business credit card allows better separation between business and personal finances, maintaining legal protections and financial transparency. Moreover, successful credit applications for business accounts can lead to improved credit scores for the business entity, opening up more financial opportunities in the future.

Legal protection

Legal protection for business bank accounts is critical for shielding both the business and its owners from potential liabilities and risks. By maintaining a separate business bank account, entrepreneurs and business owners can preserve the limited liability protection offered by certain business structures like LLCs and corporations. This separation ensures that in case of legal issues or debts faced by the business, the personal assets of the business structure and owners remain protected.

A dedicated business bank account also reinforces the legal identity of the business as a distinct entity from its owners, which is essential for contracts, legal proceedings, and tax compliance. Clear financial separation allows for accurate tracking of business-specific transactions, easing financial reporting and audits. Additionally, a separate business banking account enhances professionalism and credibility, building trust with business customers', suppliers, and investors. Mixing business and personal transactions should be avoided to maintain legal safeguards and ensure the long-term security of the business.

Tax Return

Filing a tax return for a business bank account is an essential part of the financial responsibilities for any business entity. The tax return provides the necessary financial information to the government, allowing them to assess the a business owner's tax liability accurately. Here's how the tax return process typically works for a business account:

- Business Income and Expenses: The business bank account serves as a primary source for tracking all income and expenses related to the business. Business owners or accountants compile this financial data, including sales revenue, business expenses, salaries, and other deductions.

- Business Tax Forms: The appropriate tax forms must be completed based on the business's legal structure. For example, a sole trader in the UK may file the Self Assesment taxt return as part of the owner's personal tax return, while a corporation typically files a Corporation Tax return (CT600).

- Tax Deductions: Business bank account records also help identify tax-deductible expenses, such as office supplies, business travel, equipment purchases, and employee benefits.

- Tax Payments: Depending on the business's size and profits, estimated tax payments may be required quarterly or annually to avoid penalties and interest.

- Tax Credits and Incentives: The tax return process also allows businesses to claim tax credits and incentives, which can help reduce the overall tax burden.

- Accuracy and Compliance: It is essential to ensure that the tax return is accurate and complies with all relevant tax laws and regulations to avoid potential audits or penalties.

Properly filing a tax return for a business bank account is crucial for meeting tax obligations and avoiding legal issues. Seeking the assistance of a qualified accountant or tax professional can ensure that the tax return process is handled correctly and efficiently.

Security

Business bank account security is often considered better than personal account security due to several reasons:

- Legal Protections: Business bank accounts typically offer stronger legal protections for the business entity and its owners. By keeping business and personal finances separate, business owners can safeguard their personal assets from potential business-related liabilities and legal issues, providing an added layer of security.

- Fraud Prevention Services: Many banks offer specialised fraud prevention services tailored to business accounts. These services can include advanced transaction monitoring, real-time alerts for suspicious activities, and strong encryption protocols for online banking and others. These services can help protect against check fraud and unauthorised transactions, enhancing the overall security of the account.

- Multi-User Access Control: Business accounts often allow multiple authorised users with different access levels, ensuring that sensitive financial information is limited to those who need it. This feature minimises the risk of unauthorised access and misuse of funds.

- Advanced Online Security: Business bank accounts may come with additional layers of online security, such as token authentication and multi-factor authentication, making it more challenging for cybercriminals to gain unauthorised access.

- Business-Focused Support: Banks often provide specialised support and resources for business account holders, including dedicated customer service representatives and financial tools designed for business needs.

While both a business checking account and personal bank accounts prioritise security, business accounts typically offer tailored protections and features aimed at meeting the unique financial requirements and potential risks faced by businesses. It is essential for business owners to carefully select a reputable bank and implement best practices to ensure the highest level of security for their business bank accounts.

Software Sync

Software sync for a business bank account involves integrating financial software with the bank account to enable automatic and real-time data transfer. This synchronisation streamlines financial management by automatically updating transactions, balances, and other financial data in the accounting software. It saves time, improves accuracy, facilitates efficient financial reporting, enhances cash flow management, and aids in meeting compliance requirements. However, businesses should choose secure and reliable software to ensure data confidentiality and regularly verify the accuracy of synchronised information.

Transaction Limits

Business bank accounts typically have higher transaction limits compared to personal banking accounts to accommodate larger financial needs. Deposit limits are set higher to handle substantial revenue inflows from sales and business loans. Withdrawal limits are increased to cover business expenses and employee salaries. Electronic funds transfer limits are raised to facilitate large fund transfers for payroll and vendor payments. Business debit card transaction limits are also higher to meet business-related expenses. These increased limits provide businesses with the flexibility to manage their finances effectively and handle larger transactions critical to their operations.

Why choose MultiPass as your first business account?

While there are many startup-friendly business account options offered by both banks and FinTechs, most of them cater to the single-currency and single-market needs. MultiPass stands out as a simple, all-in-one solution for companies operating in multiple currencies. If your business requires receiving payments from clients in different currencies (e.g. you have clients in the US or EU) or paying contractors in various locations like Germany or India, managing multiple currencies can become a burden and quite an expensive endeavour. MultiPass offers efficient multi-currency management, foreign exchange and access to local payment networks to ease this process.

Furthermore, companies from certain 'new' industries, such as IT, SaaS, telecommunications, fintech, digital marketing and others often find it challenging to get onboarded with traditional banks. This is because these banks don't fully understand their business, classify it as 'mid' or 'high-risk' and reject these applications focusing mostly on large businesses that have a track record of bringing them substantial profits.

However, at MultiPass, we aim to bridge this gap, investigate each business case professionally and provide reliable payment services to underserved businesses across the UK/EEA and beyond. We offer personal manager support regardless of your business's size, ensuring you have assistance whenever you need it.

So, if you're looking for a business account that simplifies multi-currency operations and comes with excellent customer support, apply today or reach out for a free consultation.

FAQ

Do I need a business bank account for a limited company?

Yes, it is highly recommended to have a business bank account for a limited company. Keeping business finances separate from personal finances is crucial for legal protection, accurate financial management, and compliance with business regulations. It helps maintain the limited liability status and ensures proper financial transparency for the company.

Do I need a business bank account as a sole trader?

While it is not a legal requirement, having a separate business bank account for your business as a sole trader is highly recommended. It helps keep personal and business finances distinct, simplifies accounting, ensures accurate financial records, and establishes a more professional image for your business.

How much money do I need to make before I can open a business bank account?

The minimum amount of money required to open a business bank account varies depending on the bank and account type. Some banks may not have a minimum deposit requirement, while others may ask for a nominal initial deposit. It's best to inquire with specific banks for their account opening requirements.

Do I need a business bank account if I am self-employed?

As a self-employed individual, you are not legally required to have a separate business bank account. However, having one is highly recommended for financial organisation and tax purposes. It simplifies tracking business income and expenses, improves financial management, and facilitates tax reporting and deductions.

Enjoy global transactions in 70+ currencies and personal manager support